This Remuneration report details Telix’s remuneration policy and practice for Key Management Personnel (KMP) for the financial year ended 31 December 2023. This report has been prepared in accordance with the Corporations Act 2001 (Cth) (Corporations Act) for the Company and its controlled entities (collectively Telix, or the Group). It has been audited by Telix’s external auditor.

1 Key Management Personnel

KMP are individuals with the authority and responsibility for planning, directing and controlling the activities of the Group, either directly or indirectly. Telix’s 2023 Remuneration report covers both the Non-Executive Directors (NED) and Executive KMP noted below during 2023 and up to the date of this report:

Name | Position | Term as KMP |

|---|---|---|

Non-Executive Directors | ||

H Kevin McCann AO | Director and Chairman | Full year |

Andreas Kluge MD PhD1 | Director | Full year |

Mark Nelson PhD | Director | Full year |

Tiffany Olson | Director | Full year |

Jann Skinner | Director | Full year |

Executive KMP | ||

Christian Behrenbruch PhD | Managing Director and Group Chief Executive Officer (MD & CEO) | Full year |

Darren Smith | Group Chief Financial Officer (CFO) | Full year |

Colin Hayward PhD2 | Group Chief Medical Officer (CMO) | Full year |

Richard Valeix | Group Chief Commercial Officer (CCO) | Full year |

2. Dr Hayward resigned as KMP and ceased employment with Telix on 31 December 2023. Dr David Cade commenced in the CMO role effective 1 January 2024, and his remuneration will be included in the 2024 Remuneration report. | ||

2 Remuneration snapshot

2.1 2023 performance highlights

During 2023, under the management of the Executive KMP, Telix delivered the following performance for the Group and shareholders:

$502.5 million 214% increase on 2022 ($160.1 million)

Adjusted EBITDAR1 $180.9 million, up from $8.2 million in 2022

31 December 2023 $10.08

39% increase on 2022 ($7.27)

31 December 2023 $3.26 billion, 42% increase on 2022 ($2.30 billion)

2.2 2023 remuneration at target

The remuneration elements (at target) for 2023 for Executive KMP are as follows:

Executive KMP | Base Salary | Short Term | Long Term | ||

|---|---|---|---|---|---|

% of base salary | Annual target1 | % of base salary | Annual target2 | ||

Christian Behrenbruch PhD (MD & CEO) | AUD 475,650 | 32% | AUD 152,208 | 50% | AUD 237,825 |

Darren Smith (CFO) | AUD 420,000 | 27% | AUD 113,400 | 50% | AUD 210,000 |

Colin Hayward MD (CMO) | USD 449,604 | 26% | USD 116,897 | 35%3 | USD 157,361 |

Richard Valeix (CCO) | CHF 295,000 | 26% | CHF 76,700 | 50% | CHF 147,500 |

2. LTVR maximum opportunity is 150% of target (subject to achievement of a stretch financial performance condition). 3. As disclosed in the 2022 Remuneration report, Dr Hayward's LTVR opportunity is 35% of base salary at target to maintain total remuneration parity. | |||||

2.3 2023 remuneration outcomes

In recognition of the significant contribution Executive KMP made to Telix’s performance in 2023, their remuneration outcomes are aligned with Group performance. Further details are provided throughout the Remuneration report, and summarised as follows:

Total Fixed Remuneration | Short Term | Long Term |

|---|---|---|

As at 1 January 2023: Other Executive KMP | MD & CEO outcome Other Executive KMP outcome | No LTVR awards were performance tested or vested in 2023 The first LTVR award will be performance tested at the end of 2024, and outcomes disclosed in the 2024 Remuneration report. |

As part of the CCO's appointment in December 2022, the Board approved a grant of 35,000 Sign on Performance Share Rights (PSRs) granted in 2023, with a second tranche of 35,000 to be granted in 2024. Refer to section 5.4.1 for details.

In addition, during 2023 two Executive KMP (the CFO and CCO) were identified by the Board to receive Performance Share Incentive Rights to be granted in 2024 (after the 2023 full year results announcement). Refer to section 5.4.2 for details.

Legacy equity awards that vested to Executive KMP during the year are detailed in section 7.1.4, and summarised below:

Plan | Grant date | Executive KMP | Grant details | Vesting details | Exercise details | |||

|---|---|---|---|---|---|---|---|---|

Type | # units | Date | Exercise price | Date | Resultant shares | |||

Unlisted share options | 13-Jan-20 | MD & CEO | Options | 200,000 | 12-Jan-23 | $2.23 | 8-Jan-24 | 153,298 |

Employee share option plan | 1-Jul-20 | CMO | Options | 400,000 | 1-Jul-23 | $1.83 | 29-Aug-23 | 331,907 |

3 2023 Executive KMP remuneration overview

3.1 Remuneration principles

3.2 2023 Remuneration philosophy

Telix’s Executive KMP are responsible for making and executing decisions that build Telix’s value. In setting the remuneration philosophy and design, the Board aims to balance reward for short-term results with long-term business performance and value creation. The Board’s aim is to provide clarity so that shareholders, executives, and all other stakeholders understand how remuneration at Telix helps drive the business strategy, shareholder alignment and reward outcomes.

3.3 2023 Remuneration framework

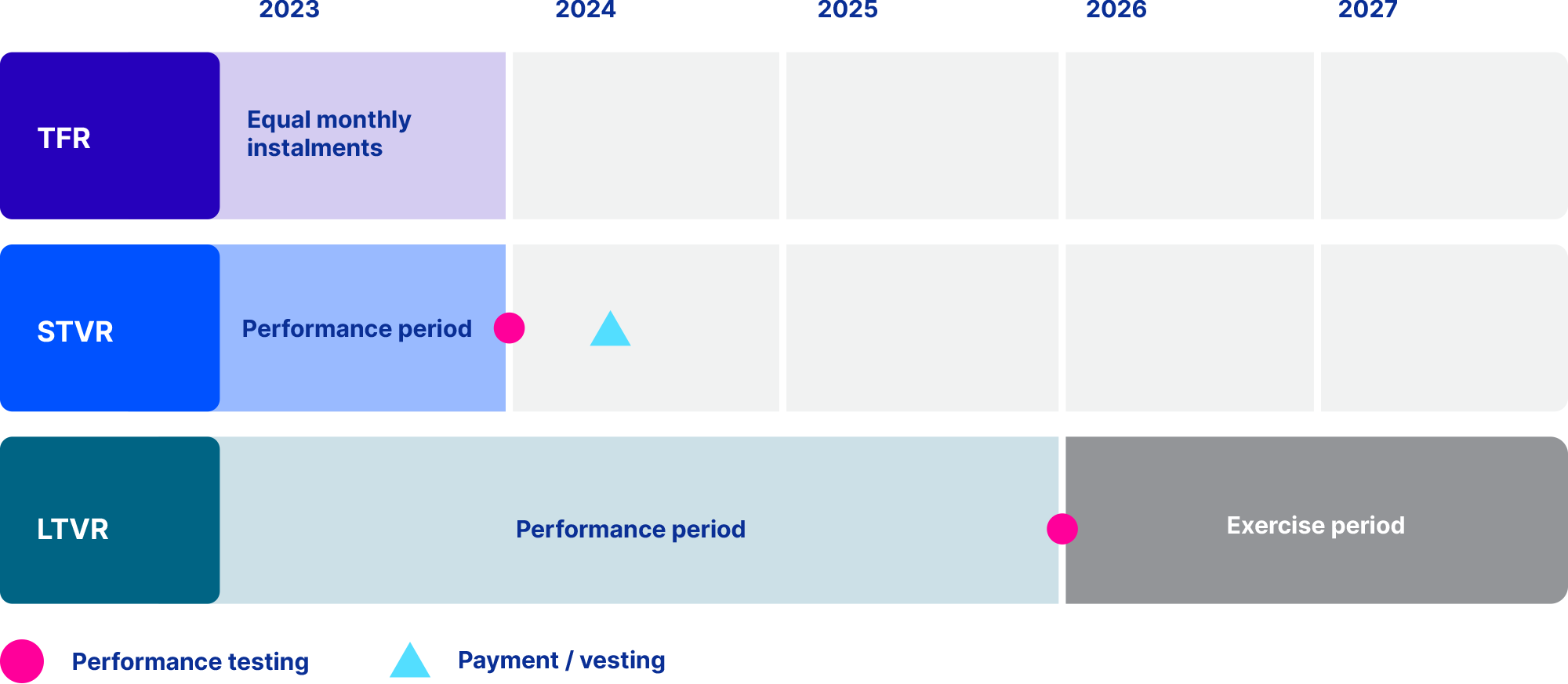

The 2023 remuneration framework for Executive KMP detailed in this report includes the following elements:

Total Fixed | Short Term Variable Remuneration (STVR) | Long Term Variable Remuneration (LTVR) | |

|---|---|---|---|

Purpose | Attract and retain global talent capable of leading and delivering Telix’s strategy. | Reward achievement of Telix’s annual corporate objectives aligned to the delivery of Telix’s strategy. | Reward long-term performance aligned with delivery of Telix’s strategic objectives. |

Remuneration setting | TFR is set considering the elements mentioned under ‘Rationale’ below, and detailed in section 2.2. | Target STVR remuneration for Executive KMP is set as a % of base salary and detailed in section 2.2. The maximum outcome is 100% of target. | Target LTVR remuneration for Executive KMP is set as a % of base salary and detailed in section 2.2. |

Composition and delivery | Base salary and statutory pension/superannuation contributions paid in equal monthly cash instalments over the year, and packaged benefits.1 | Annual performance incentive delivered in cash following completion of the performance period and assessment of performance (approximately February the following year).2 | Award of Performance Share Appreciation Rights (PSARs)3 subject to achievement of 3-year performance and vesting conditions. |

Rationale | TFR is set with consideration of:

| STVR rewards performance against annual financial and non-financial corporate objectives – maintaining a focus on underlying value creation within the business operations. | LTVR aligns the interests of Executive KMP with shareholders and rewards the achievement of long-term, sustainable performance and shareholder value creation. |

2. Refer to section 8.3.2 regarding the introduction of equity deferral for Executive KMP STVR participation from 1 January 2024. 3. PSARs and other equity incentives are granted in accordance with the Equity Incentive Plan rules (approved by shareholders at the 2022 AGM). | |||

Other remuneration elements

To attract and retain a strong and cohesive Executive team, additional remuneration awards may be made including sign-on incentives, retention incentives and other one-off incentives, aligned to Telix’s remuneration principles and philosophy.

As part of the CCO’s appointment in December 2022, the Board approved a grant of 35,000 Sign On Performance Share Rights (PSRs) granted in 2023, and an additional tranche of 35,000 PSRs to be granted in 2024. See section 5.4.1.

During 2023, two Executive KMP (the CFO and CCO) were identified to receive Performance Share Incentive Rights (PSIRs) in 2024 (after the 2023 full year results announcement). This grant will retain and motivate these business critical individuals in the execution of Telix’s strategy and the creation of long-term sustainable value for shareholders. This is a one off grant. Refer to section 5.4.2 for further details.

3.4 Remuneration delivery

The following diagram illustrates how remuneration was delivered to Executive KMP in 2023:

3.5 Remuneration mix

The table and diagrams below reflect the remuneration elements at target from section 2.2 as a percentage of base salary and total remuneration mix for each individual Executive KMP.

Executive KMP | % of base salary | % of total remuneration mix | ||||

|---|---|---|---|---|---|---|

Base salary | STVR | LTVR | TFR | STVR | LTVR | |

Christian Behrenbruch PhD (MD & CEO) | 100% | 32% | 50% | 57% | 17% | 26% |

Darren Smith (CFO) | 100% | 27% | 50% | 58% | 14% | 28% |

Colin Haward MD (CMO) | 100% | 26% | 35% | 63% | 16% | 21% |

Richard Valeix (CCO) | 100% | 26% | 50% | 59% | 14% | 27% |

As demonstrated above, the current remuneration mix is heavily weighted towards fixed pay (57 – 63% of total target remuneration). Refer to section 8.3.1 for details regarding changes to the remuneration mix to apply from 1 January 2024.

4 Remuneration governance

4.1 Governance framework

The Governance of Telix’s remuneration framework ensures that:

the Board delegates specific responsibilities to the PCNRC which provides recommendations to the Board

Telix’s strategic objectives, corporate governance principles, market practice and stakeholder interests are considered, and

achievement of pre-determined financial results and strategic objectives is rewarded through sustainable means for KMP.

Roles in the Governance framework | |

|---|---|

THE BOARD has overall responsibility for oversight of Telix’s remuneration approach for KMP (NEDs and Executives). With input and guidance from the PCNRC, the Board is responsible for:

| THE PCNRC assists the Board in fulfilling its responsibilities to shareholders and regulators in relation to the Group’s people and culture, nomination and remuneration policies and practices. From a remuneration perspective, the PCNRC assists and advises the Board with recommendations related to:

The PCNRC may engage external advisors to provide information to assist in making remuneration decisions. |

MANAGEMENT provides relevant information and analysis required to support effective decision making, including for remuneration related considerations. | EXTERNAL ADVISORS1 may be engaged by the PCNRC to provide:

|

AUDIT AND RISK COMMITTEE assists the Board with the Group’s risk management framework and risk appetite. | |

Further information on the Board’s role and Telix’s corporate governance policies (including the Securities Dealing Policy) can be found in Telix’s 2023 Corporate Governance Statement and on Telix’s website at: telixpharma.com/investor-centre/corporate-governance/. Telix’s Securities Dealing Policy prohibits hedging or margin lending in respect of Telix securities.

4.2 Malus and clawback

The Board in its sole discretion, may reduce, cancel in full, or seek to clawback any incentive provided to any Executive KMP, including former Executive KMP, if it determines that at any time the Executive KMP:

acted dishonestly (including, but not limited to, misappropriating funds or deliberately concealing a transaction)

acted or failed to act in a way that contributed to Telix making a material financial misstatement

acted or failed to act in a way that contributed to a breach of a significant legal or regulatory requirement relevant to Telix

acted or failed to act in a way that contributed to Telix incurring significant reputational harm, a significant unexpected financial loss, impairment charge, cost or provision

exposed employees, the broader community or environment to excessive risks, including risks to health and safety

breached their post-employment conditions (unless otherwise determined by the Board)

committed a breach or non-compliance with Telix’s Code of Conduct and/or any other employee or governance related policies, and/or

took excessive risks or contributed to or may benefit from unacceptable cultures within the Group.

5 Executive remuneration framework

5.1 Total Fixed Remuneration (TFR)

Executive KMP receive TFR in equal monthly instalments.

Element | 2023 TFR principles |

|---|---|

Market data | Benchmarked against similar Executive roles within ASX listed companies based on both market capitalisation and industry. The Board is committed to increase TFR over time to align base salary to the median (50th percentile) of the market. |

Timing of review | Executive TFR is reviewed annually in line with Telix’s performance review cycle. |

Refer to section 8.3.1 regarding changes to the remuneration mix that will apply from 1 January 2024.

5.2 Short-term Variable Remuneration (STVR)

Executive KMP participated in the 2023 STVR under the following terms:

Feature | Key terms of the 2023 STVR | ||||

|---|---|---|---|---|---|

Performance period | 1 January to 31 December 2023 | ||||

Opportunity | The STVR opportunity as a percentage of base salary for each Executive KMP is: | ||||

MD & CEO | CFO | CMO | CCO | ||

Minimum | 0% | 0% | 0% | 0% | |

Target | 32% | 27% | 26% | 26% | |

Maximum (100% of target1 | 32% | 27% | 26% | 26% | |

Weighting | All Executive KMP are measured against the STVR scorecard, which comprises 100% of their STVR opportunity. | ||||

Outcome scale | The outcome for each performance measure is determined as either:

| ||||

Delivery | STVR outcomes are delivered in cash following completion of the performance period and assessment of performance (February 2024).2 | ||||

Treatment on cessation of employment | Participants who depart Telix prior to the cash payment date are generally treated as follows, although the Board retains discretion to determine a different treatment:

| ||||

2. See section 8.3.2 regarding the introduction of equity deferral for STVR participation from 1 January 2024. | |||||

5.3 Long Term Variable Remuneration (LTVR)

5.3.1 2023 LTVR Key terms

Executive KMP participated in the 2023 LTVR under the following terms:

Feature | Key terms of the 2023 LTVR | ||||

|---|---|---|---|---|---|

Offer | LTVR grants are awarded in the form of Performance Share Appreciation Rights (PSARs). PSARs are the right to acquire shares in Telix equal in value to the gain above the notional 'exercise' price, subject to the satisfaction of specific performance conditions set by the Board, plus terms and conditions over the Performance Period. | ||||

Notional 'exercise' price | $6.90, being the volume weighted average price (VWAP) of Telix shares over the 20 trading days following the announcement of the 2022 full year annual results (28 February to 28 March 2023). | ||||

Performance Period | 1 January 2023 to 31 December 2025 | ||||

Opportunity | The LTVR opportunity as a percentage of base salary for each Executive KMP is: | ||||

MD & CEO | CFO | CMO | CCO | ||

Minimum | 0% | 0% | 0% | 0% | |

Target | 50% | 50% | 35% | 50% | |

Maximum (150% of target)1 | 75% | 75% | 52.5% | 75% | |

Grant | PSARs were granted at stretch target to the MD & CEO on 24 May 2023 following shareholder approval at the 2023 Annual General Meeting. All Other Executive KMP were granted PSARs at target on 2 May 2023. As detailed in the 2023 Notice of Meeting, the number of PSARs granted was determined on the concluded value of $2.9662, being the fair value price of $3.7866 (the independently determined Black Scholes valuation), adjusted for the probability of achievement of the non-market vesting conditions. | ||||

Performance conditions and weightings | As disclosed in the 2022 Remuneration report, the following performance conditions apply over the Performance Period (further details in Section 5.3.2): | ||||

Performance condition | % of PSARs that vest at target | ||||

Financial measure: | |||||

Adjusted EBITDAR (Earnings Before Interest, Taxes, Depreciation and Amortisation and Research & Development expense) | 50% | ||||

Product Milestones: | |||||

| 25% | ||||

| 25% | ||||

Testing outcomes | Following the release of the audited 2025 full-year results in approximately February 2026, the PSARs related to the achievement of each metric that vest are calculated as follows (refer 5.3.2 for further details regarding the metrics): | ||||

Adjusted EBITDAR (50% weighting at target) | % of PSARs that vest at target | ||||

Below threshold | 0% | ||||

At threshold | 25% | ||||

Between threshold and target | Straight-line pro-rata vesting between threshold and target | ||||

Target | 50% | ||||

Between target and stretch | Straight-line pro-rata vesting between target and stretch | ||||

Stretch1 | 100%1 | ||||

Product Milestone 1 (25% weighting at target) | % of PSARs that vest at target | ||||

ProstACT GLOBAL Phase III Interim read-out | |||||

| 25% | ||||

| 0% | ||||

Product Milestone 2 (25% weighting at target) | % of PSARs that vest at target | ||||

Pre-pivotal trial (pre-IND) meeting completed with a major regulator for one of Telix’s rare disease therapy programs | |||||

| 25% | ||||

| 0% | ||||

Performance assessment / expiry period | At the end of the performance period and after the audited results are finalised, performance will be assessed and subject to achieving the performance conditions as set out above, PSARs will vest. If the performance condition(s) are not met at the time of performance testing, PSARs are forfeited and not retested. In certain circumstances the Board may determine that participants may receive a cash equivalent value of the vested element after testing. PSARs have a term of five years from the grant date and rights that are not exercised before the end of their term will lapse. The 2023 PSARs testing outcomes will be reported in the 2025 Remuneration report. | ||||

Other details | Unvested and vested but unexercised PSARs have no dividend or voting rights. PSARs are held subject to Telix’s Securities Dealing Policy. Treatment of PSARs are subject to Board discretion in the case of other events (e.g. change of control). | ||||

Treatment on cessation of employment | Participants who depart Telix prior to vesting are generally treated as follows, although the Board retains discretion to determine a different treatment:

| ||||

5.3.2 2023 LTVR performance conditions

Measures | Adjusted EBITDAR | Product Milestone 1 | Product Milestone 2 |

|---|---|---|---|

Description | Adjusted EBITDAR on a 3-year cumulative basis. | ProstACT GLOBAL Phase III interim read-out completed. | Pre-pivotal trial (pre-IND) meeting completed with a major regulator for one of Telix’s rare disease therapy programs. |

Rationale | Demonstrates Telix’s underlying performance before non-operating expenditure, finance costs, depreciation and amortisation, taxation expense and research and development activities. | Telix’s growth strategy is reliant on the advancement of therapeutic programs, and continued commercialisation of Telix’s diagnostic products. The prostate cancer therapy program ProstACT Global, and Telix’s range of rare disease therapies and diagnostics are key drivers to provide the greatest impact for Telix’s patients and create long-term, sustainable growth and value creation for Telix’s shareholders. | |

Complexity and strategic significance | Reflects Telix’s commercial earnings. | This achieves the first Phase III efficacy data for this therapeutic candidate. Achievement requires the granting of an IND to commence the study in sites outside of Australia and enrolment of 120 patients. | This requires extensive development, including clinical progress, manufacturing and regulatory engagement and completion of the final clinical trial (as required) ahead of a regulatory filing. |

Calculation | Refer to the Alternative performance measures section in the Annual report. | Either achieved or not achieved milestone measure (hit/miss). | |

Measure type | Financial | Strategic delivery | Strategic delivery |

Setting of targets | The Board sets the targets at the outset of each performance period. Targets are set to be sufficiently challenging for Executives and deliver appropriate returns for shareholders. These measures reflect Telix’s transition to a commercial, revenue-generating, financially sustainable company and balance with advancement of therapeutic programs as part of Telix’s growth strategy. | ||

2023 LTVR targets | Threshold $227 million | Target: complete milestone | Target: complete milestone |

5.3.3 2024 LTVR key terms and performance conditions

Executive KMP will be eligible to participate in the 2024 LTVR under the following terms:

Feature | Key terms of the 2024 LTVR |

|---|---|

Performance period | 1 January 2024 to 31 December 2026 |

Offer and notional 'exercise' price | Similar to the key terms of the 2023 LTVR in section 5.3.1, the 2024 LTVR grant will be awarded in the form of Performance Share Appreciation Rights (PSARs). PSARs are the right to acquire shares in Telix equal in value to the gain above the notional 'exercise' price, subject to the satisfaction of specific performance conditions set by the Board, plus terms and conditions over the Performance Period. The notional 'exercise' price will be calculated based on the VWAP of Telix shares over the 20 trading days following the announcement of the 2023 full year results. |

Grant | For the MD & CEO, if shareholder approval is granted at the 2024 AGM, 2024 LTVR will be granted at stretch target on the grant date soon thereafter. The number of PSARs granted will be determined on the concluded value, being the independently determined Black Scholes valuation adjusted for the probability of achievement of the non-market vesting conditions. The grant of 2024 LTVR will be made to Other Executive KMP in approximately April/May 2024. |

Performance assessment and expiry period | The same terms apply as detailed in section 5.3.1, however the 2024 PSARs will have an exercise period of two years from vesting, which will occur after the audited results are finalised in approximately February 2027. The 2024 PSARs testing outcomes will be reported in the 2026 Remuneration report. |

The performance conditions for the 2024 LTVR are as follows:

Measures | Adjusted EBITDAR | Product Milestone 1 | Product Milestone 2 |

|---|---|---|---|

Description | Adjusted EBITDAR on a 3-year cumulative basis. | Marketing authorisation application submitted in a commercially relevant jurisdiction for prostate cancer therapy. | Interim data readout from a global phase III trial in renal cancer therapy. |

Rationale | Demonstrates Telix’s underlying performance before non-operating expenditure, finance costs, depreciation and amortisation, taxation expense and research and development activities. | Supports Telix's growth strategy with the advancement of therapeutic programs. Both milestones will accelerate Telix's pathway to a commercial therapeutics company. | |

Complexity and strategic significance | Reflects Telix's commercial earnings. | Requires successful completion of a pivotal clinical trial and manufacturing validation. The completion of these major developmental milestones will signal near-term transition to a commercial stage therapeutic in a large indication, strengthening our urology franchise. | Requires positive data from prior studies, execution of a multi-site Phase III study, requisite regulatory clearances and manufacturing scale-up. An interim readout will provide valuable insights and opportunities to profile the candidate at major medical congresses and engage with key opinion leaders in the field. |

Calculation | Refer to the Alternative performance measures section in the Annual report | Either achieved or not achieved milestone measure (hit/miss). | |

Measure type | Financial | Strategic delivery | Strategic delivery |

Setting of targets | The Board sets the targets at the outset of each performance period. Targets are set to be sufficiently challenging for Executives and deliver appropriate returns for shareholders. These measures reflect Telix’s transition to a commercial, revenue-generating, financially sustainable company and balance with advancement of therapeutic programs as part of Telix’s growth strategy. | ||

2024 LTVR targets | Threshold US$410 million Target US$450 million | Target: complete milestone | Target: complete milestone |

5.4 Other equity grants

5.4.1 Performance Share Rights (PSRs)

The key terms of the first tranche of the CCO’s sign on PSRs granted in 2023 are as follows:

Feature | Key terms of the sign on Performance Share Rights |

|---|---|

Offer | PSRs are the right to acquire shares in Telix subject to the satisfaction of performance conditions set by the Board, plus terms and conditions over the Performance Period. |

Performance Period | 3 years (1 January 2023 to 31 December 2025). |

Opportunity | The Board determined the CCO would receive a grant of 35,000 PSRs in 2023. |

Grant | PSRs were granted on 6 July 2023. |

Performance conditions and weightings | The same terms apply as detailed in section 5.3.1 for the PSRs. |

Testing outcomes | The same terms apply as detailed in section 5.3.1 for the PSRs. |

Performance assessment / expiry period | The same terms apply as detailed in section 5.3.1 for the PSRs. |

Other details | The same terms apply as detailed in section 5.3.1 for the PSRs. |

Treatment on cessation of employment | The same terms apply as detailed in section 5.3.1 for the PSRs. |

5.4.2 Performance Share Incentive Rights (PSIRs)

The key terms of the PSIRs the Board determined to grant to the CFO and CCO in 2024 are as follows:

Feature | Key terms of the Performance Share Incentive Rights | ||

|---|---|---|---|

Offer | PSIRs are the right to acquire shares in Telix subject to the satisfaction of specific performance conditions and terms and conditions over the Performance Period. | ||

Performance Period | Tranches 1 and 2 are subject to a performance period of 3 years (1 January 2024 to 31 December 2026). Tranche 3 is subject to a performance period of 4 years (1 January 2024 to 31 December 2027). | ||

Opportunity | In 2023, the Board determined two Executive KMP (CFO and CCO) would receive grants of 70,000 PSIRs each, to be granted in 2024. | ||

Grant | PSIRs will be granted in the open period (as detailed in the Securities Dealing Policy) after the 2023 full year results announcement (on or after 23 February 2024). | ||

Performance conditions and weighting | For PSIRs to vest, the Board approved performance conditions must be met within the relevant Performance Period, and the employee must remain employed, and in good standing, at the testing date for each tranche to vest. If the performance conditions are not achieved, the full tranche will lapse. The performance conditions are aligned to Telix’s strategic objectives as follows: | ||

Tranche | Performance condition | Weighting | |

1 | Financial measure - Adjusted EBITDAR | 25% | |

2 | Financial measure - Revenue | 25% | |

3 | Product milestone | 50% | |

Testing outcomes1 | Following the release of the audited 2026 full-year results in approximately February 2027, 50% of the PSIRs related to the achievement of the two financial metrics that vest are calculated as follows: | ||

Financial measure 1 (25% weighting at target) | % of PSIRs that vest at target | ||

Below target | 0% | ||

Target | 25% | ||

Financial measure 2 (25% weighting at target) | % of PSIRs that vest at target | ||

Below target | 0% | ||

Target | 25% | ||

Following the release of the audited 2027 full-year results in approximately February 2028, 50% of PSIRs related to the achievement of the product milestone that vest are calculated as follows: | |||

Product Milestone (50% weighting at target) | % of PSIRs that vest at target | ||

Completed | 50% | ||

Not completed | 0% | ||

Performance assessment / expiry period | At the end of each performance period after the audited results are finalised (testing date), performance will be assessed and subject to achieving the performance conditions as set out above, PSIRs will vest. If the performance condition(s) are not met at the time of performance testing, PSIRs are forfeited and not retested. In certain circumstances, the Board may determine that participants may receive a cash equivalent value of the vested element after testing. PSIRs have an exercise period of two years from the testing date and rights that are not exercised before the end of their term will lapse. The PSIRs targets and outcomes will be fully disclosed in the 2026 and 2027 Remuneration reports, as applicable. | ||

Other details | Unvested and vested but unexercised PSIRs have no dividend or voting rights. PSIRs are held subject to Telix’s Securities Dealing Policy. Treatment of PSIRs is subject to Board discretion in the case of other events (e.g. change of control) within ASX Listing Rules. | ||

Treatment on cessation of employment | Where participants depart Telix prior to vesting, they are generally treated as follows, although the Board retains the discretion to determine a different treatment:

| ||

5.5 Executive KMP employment arrangements

All Executive KMP are employed on ongoing, permanent contracts and have notice period and cascading non-compete and non-solicit clauses in their employment agreements as summarised below:

Role | Notice period | Non-compete and non-solicit |

|---|---|---|

Christian Behrenbruch PhD (MD & CEO) | 3 months | Non-compete and non-solicit: 6, 3 months Restricted area: Australia/United Kingdom/ European Union or United States; Victoria; Melbourne |

Darren Smith (CFO) | 4 months | Non-compete and non-solicit: 6, 3, 1 months Restricted area: Australia; Victoria; Melbourne |

Colin Hayward PhD (CMO)1 | 3 months | Non-compete and non-solicit: 6 months Restricted area: Australia/United Kingdom/ European Union/United States |

Richard Valeix (CCO) | 3 months | Non-compete and non-solicit: 12 months Restricted area: Switzerland/the European Union/ the United Kingdom/Australia/the United States/Canada/Japan and China |

Employment may be terminated by either the Executive or Telix on the provision of notice in the minimum period stated above. In the event of termination for cause, Telix may terminate an Executive’s employment immediately without notice.

6 Telix performance and shareholder wealth

In line with Telix’s remuneration principles and philosophy, performance measures are chosen to align Executive KMP and shareholder interests and to ensure variable remuneration is contingent on outcomes that grow and protect shareholder value.

The following table outlines Telix’s financial performance for 2019 to 2023.

Type | Measure | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

Short-term measures | Revenue from contracts with customers ($'000) | 502,547 | 160,096 | 7,596 | 5,213 | 3,485 |

Net cash from/(used in) operating activities ($'000) | 23,884 | (63,970) | (59,328) | 1,960 | (23,333) | |

Long-term measures (non-IFRS measures) | Adjusted EBITRD ($’000)1 | 174,177 | 2,849 | (35,622) | (14,804) | (12,300) |

Adjusted EBITDAR ($'000)2 | 180,920 | 8,228 | (30,448) | (9,922) | (8,064) | |

Other measures | Profit/(loss) before income tax ($’000) | 3,087 | (98,622) | (80,465) | (47,935) | (31,122) |

Basic earnings/(loss) per share (cents) | 1.6 | (33.5) | (28.5) | (17.5) | (11.9) | |

Net tangible assets per share ($) | 0.04 | 0.03 | (0.20) | 6.44 | 11.83 | |

Dividend per share ($) | - | - | - | - | - | |

Closing share price ($) | 10.08 | 7.27 | 7.75 | 3.78 | 1.55 | |

Increase/(decrease) in share price (%) | 39 | (6) | 105 | 144 | 138 | |

Market capitalisation ($'000) | 3,263,165 | 2,299,812 | 2,209,315 | 1,059,932 | 392,584 | |

2. Adjusted EBITDAR (Earnings Before Interest, Taxes, Depreciation and Amortisation and R&D expenses is the 2023 LTVR financial metric | ||||||

7 2023 Executive KMP remuneration outcomes

The outcomes of variable remuneration for 2023 and 2022 year are summarised below:

MD & CEO | Other Executive KMP1 | ||||

2023 | 2022 | 2023 | 2022 | ||

|---|---|---|---|---|---|

STVR | % of Target | 79% | 60% | 79% | 60% |

% of Maximum2 | 79% | 60% | 79% | 60% | |

LTVR | % of opportunity vested | n/a during 2023 (first testing will be reported in the 2025 Remuneration report) | |||

2. The maximum STVR opportunity is 100% of target (there is no over-earn potential). | |||||

7.1 Short Term Variable Remuneration (STVR)

7.1.1 Performance against STVR scorecard

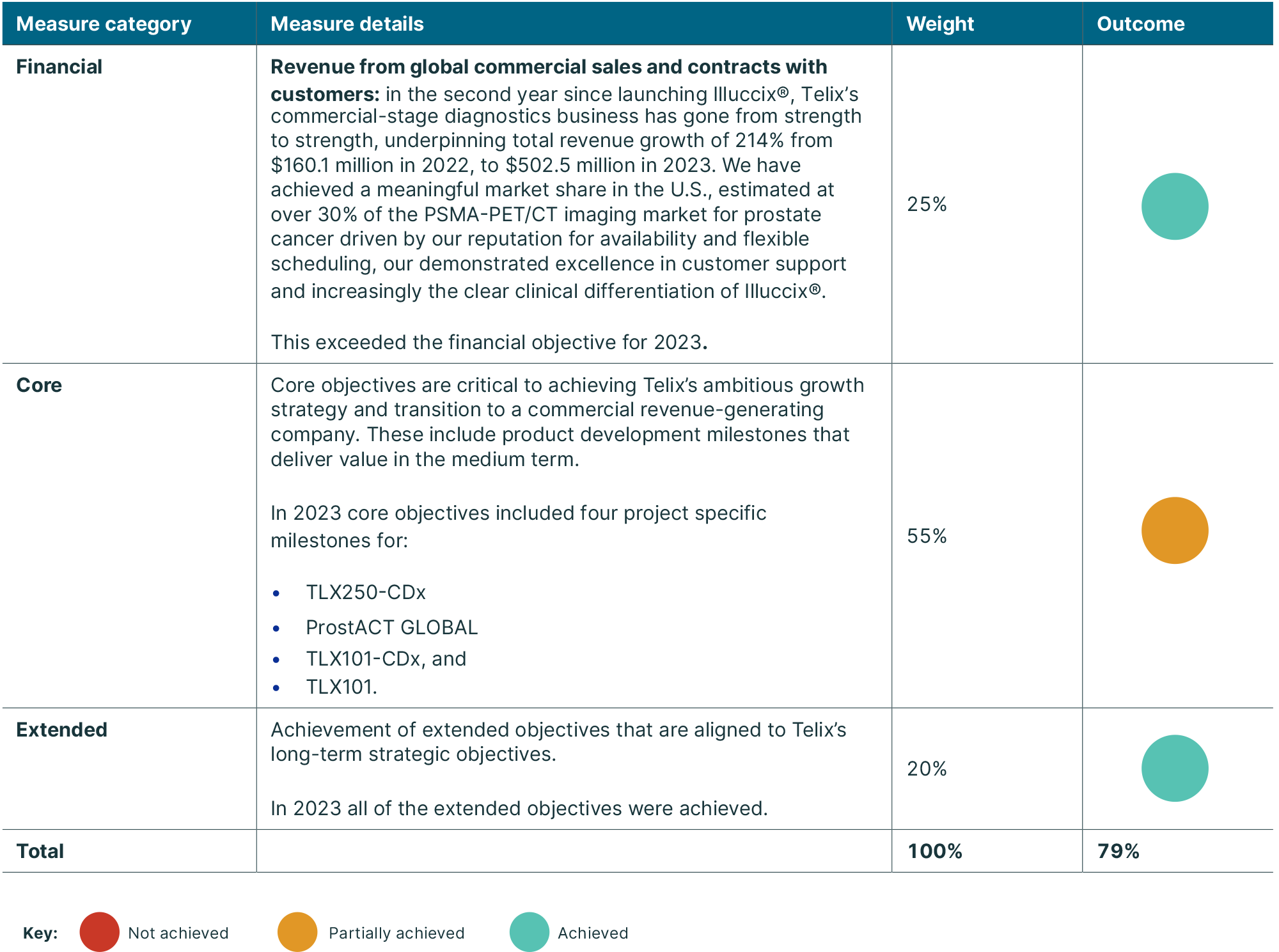

At the commencement of each financial year the Board reviews and approves the objectives, weightings and targets for the STVR scorecard, aligned to Telix’s strategic objectives. For 2023 the scorecard aligned to three key themes:

Financial measures

Core objectives, and

Extended objectives.

The following table outlines performance against the 2023 STVR scorecard measures:

7.1.2 2023 Executive KMP STVR outcomes

In addition to the STVR scorecard, the Board considers a range of quantitative and qualitative factors when determining STVR outcomes and may apply its informed judgement and discretion to adjust STVR outcomes to ensure they are fair, appropriate, and aligned to Telix’s overall performance and shareholder outcomes.

The Board considers how performance outcomes are achieved in line with Telix’s Code of Conduct and corporate values (refer section 4.2).

For 2023 the Board assessed the STVR scorecard alongside these factors and approved STVR outcomes of 79% of target/maximum for all Executive KMP, as follows:

Name | Target / Maximum1 STVR | Actual STVR awarded | STI actual as % of maximum STVR | % of maximum STVR forfeited |

|---|---|---|---|---|

Christian Behrenbruch PhD (MD & CEO) | AUD 152,208 | AUD 120,244 | 79% | 21% |

Darren Smith (CFO) | AUD 113,400 | AUD 89,586 | 79% | 21% |

Colin Hayward PhD (CMO)2 | USD 116,897 | - | - | 100% |

Richard Valeix (CCO) | CHF 76,700 | CHF 60,593 | 79% | 21% |

2. Due to Dr Hayward's notice of resignation prior to the payment date, his 2023 STVR was forfeited in full. | ||||

7.1.3 2023 Executive KMP LTVR vesting outcomes

No LTVR awards were performance tested or vested in 2023. The first LTVR award will be performance tested at the end of 2024 and will be disclosed in the 2024 Remuneration report.

7.1.4 Other equity held by Executive KMP during 2023

Other equity awards for individual Executive KMP that vested during 2023 are detailed in section 2.3.

The following plans vested during 2023 or remain in the performance period for current Executive KMP:

Equity type | Grant date | Restricted period | Vesting date | Performance conditions | Exercise price | Status |

|---|---|---|---|---|---|---|

Unlisted share options plan | 13-Jan-20 | 13 Jan 2020 to 13 Jan 2023 (3 years) | 13-Jan-23 | Meeting the exercise price | $2.23 | Vested |

Employee share option plan | 1-Jul-20 | 1 Jul 2020 to 1 Jul 2023 (3 years) | 1-Jul-23 | Meeting the exercise price | $1.83 | Vested |

PSARs (2022 LTVR)1 | 5-Apr-22 | 1 Jan 2022 to 31 Dec 2024 (3 years) | 31-Dec-24 | 50% EBITRD $100m; | $4.95 | In Restricted period |

Sign-on PSARs | 24-Oct-22 | 1 Jan 2022 to 31 Dec 2024 (3 years) | 31-Dec-24 | As above | $6.15 | In Restricted period |

PSARs (2023 LTVR)2 | 2-May-23 and 24-May-23 | 1 Jan 2023 to 31 Dec 2025 (3 years) | 31-Dec-25 | 50% EBITDAR $332m; ProstACT Global Phase III interim read-out; Pre-pivotal trial meeting completed with a major regulator for one of Telix’s rare disease therapy programs | $6.90 | In Restricted period |

PSRs3 | 6-Jul-23 | 1 Jan 2023 to 31 Dec 2025 (3 years) | 31-Dec-25 | As above | $0.00 | In Restricted period |

2. Refer to sections 5.3.1 and 5.3.2 for full details 3. Refer to section 5.4 for full details | ||||||

8 Key events impacting remuneration

8.1 Executive KMP resignation and appointment

Dr Colin Hayward resigned as Chief Medical Officer (and Executive KMP) effective 31 December 2023. Section 10 and relevant footnotes provide further detail regarding the remuneration he received for the year ended 31 December 2023.

Effective 1 January 2024, Dr David Cade was appointed to the role of Chief Medical Officer (and Executive KMP) and will be included in the 2024 Remuneration report.

8.2 Appointment of Remuneration Consultant

During 2023, the PCNRC through the Chairman engaged Mercer Consulting (Australia) Pty Ltd (Mercer) to conduct a market analysis and review of Telix’s Executive Remuneration structure and quantum compared to selected peers based on market capitalisation and industry.

Mercer provided a remuneration recommendation as defined in section 9B of the Corporations Act in 2023 as part of their review of Telix’s MD & CEO, and Other Executive KMP remuneration. The Board is satisfied that the remuneration recommendation and other advice provided by Mercer during 2023 was provided free from undue influence from the Executive KMP to whom the recommendation relates.

Mercer also provided benchmarking data, but no remuneration recommendation, relating to Telix’s NED fees and aggregate fee limit. Further details are provided regarding the NED review and the Board's proposed response in section 9.2.2.

Total fees payable to Mercer during 2023, excluding GST and disbursements were $110,605, comprising $27,500 in relation to the Executive KMP remuneration recommendation and $83,105 in relation to other remuneration related benchmarking services provided by Mercer (excluding Executive KMP) during 2023.

8.3 Remuneration framework for 2024

8.3.1 Remuneration mix and delivery to implement Remuneration Consultant recommendations

In line with the commitment to increase fixed remuneration over time to align to the median (50th percentile) of the market, in 2024 the Board will implement year one of the recommended changes to Executive KMP remuneration made by Mercer, including TFR increases.

In addition, as shown in section 3.5, Mercer found that Telix’s Executive KMP remuneration is heavily weighted to TFR compared to the market benchmark. The implementation of the first year of recommended changes will address the first step of progressive change and alter Telix’s remuneration mix to increase the weighting of variable pay components (STVR and LTVR). This change will also better align with shareholder interests by increasing the proportion of variable performance-based remuneration and level of shareholding held by Executive KMP.

As shown in the below table and diagrams, the remuneration mix has changed from 2023 (see section 3.5) such that the fixed pay component of total remuneration at target for the MD & CEO will reduce from 57% to 40%, and Other Executive KMP will reduce from 58-63% to 53-54%:

Executive KMP | % of base salary | % of total remuneration mix | ||||

|---|---|---|---|---|---|---|

Base salary | STVR | LTVR | TFR | STVR | LTVR | |

Christian Behrenbruch PhD (MD & CEO) | 100% | 65% | 100% | 40% | 24% | 36% |

Darren Smith (CFO) | 100% | 35% | 60% | 54% | 17% | 29% |

David Cade MD, MBA (CMO) | 100% | 35% | 60% | 53% | 17% | 30% |

Richard Valeix (CCO) | 100% | 35% | 60% | 54% | 17% | 29% |

In addition to these changes to Executive KMP remuneration, as detailed in section 9.2.2, if the aggregate NED fee limit resolution is passed by shareholders at the 2024 Annual General Meeting, Board and Committee fees will also be increased to align to the market median over time.

8.3.2 2024 STVR changes

The Board has determined that from 1 January 2024, a proportion of Executive KMP STVR outcomes will be subject to deferral into equity. The Board has adopted Deferred Share Rights to align overall reward outcomes with value creation for shareholders, act as a retention tool and increase the shareholdings of Executive KMP.

The Deferred Share Rights will be restricted from dealing for 12 months from grant. The non-deferred portion of the STVR award will be made in cash following the release of the applicable end of year results (generally in February the following year).

The introduction of equity deferral for STVR will occur over two years as follows:

for the first year (2024) 25% of the STVR outcome will be granted as deferred share rights restricted for 12 months to approximately February 2026, with the remaining 75% of the STVR outcome paid in cash in February 2025, and

in the second year (2025) 50% of the STVR outcome will be granted as deferred share rights restricted for 12 months to approximately February 2027, with the remaining 50% of the STVR outcome paid in cash in February 2026.

All information regarding the Deferred Share Rights and 2024 outcomes will be fully detailed in the 2024 Remuneration report. Any Deferred Share Rights proposed to be granted to the MD & CEO will be subject to shareholder approval and will be included as a shareholder resolution at the 2025 Annual General Meeting as required.

9 Non-Executive Director (NED) remuneration

9.1 NED remuneration framework

To ensure Telix attracts and retains suitably qualified individuals, NED fees are set to reflect the obligations, responsibilities and demands of Directors. They are reviewed periodically by the Board, considering market benchmark data and the financial position of the Group. NEDs receive fees as a Director of Telix, and for their membership and chairing of applicable Board Committees. NEDs do not receive any performance-based remuneration. No equity grants were made to NEDs in 2023.

As an Australian headquartered business, overseas-based NEDs may be required to undertake additional travel to attend meetings or other Board-related matters in Australia. Effective 1 January 2023, a travel allowance of $10,000 was put in place for internationally based NEDs who travel to and from Australia to attend two Board and/or Committee meetings or other Board-related matters during the year. The allowance is in addition to the reimbursement of travel costs.

There is currently no minimum shareholding requirement for NEDs or retirement benefit scheme (other than statutory superannuation contributions for Australia-based NEDs, which are paid in addition to fees).

9.2 NED remuneration approach

The NED aggregate fee limit of $700,000 per annum was approved by shareholders at the 2021 Annual General Meeting. Total NED remuneration paid during 2023 was $584,541, within the fee limit (83.5% of the fee pool).

With the growth of Telix in the last three years, this limit was reviewed during 2023. The Board will seek to increase the aggregate fee level for NEDs from $700,000 to $1,350,000 via shareholder resolution at the 2024 Annual General Meeting. If the fee pool increase is approved by shareholders, the Board will increase NED fees to align with the benchmarking data provided by Mercer in 2023 with the remuneration changes effective from 1 January 2024. Further details are provided in section 9.2.2.

9.2.1 2023 Board and Committee fees

NEDs receive a base fee for being a Director of the Board, and additional annual fees for membership or chairing of applicable Committees as outlined below. These amounts exclude superannuation or other relevant statutory requirements, as applicable. The Chairman of the Board is not compensated for Committee Membership but is compensated for his role as Chair of the PCNRC.

Committee and Board fees were set effective 1 January 2022, and applied in 2023 as follows:

Board and Committee Fees1 | Chair | Member |

|---|---|---|

Board | $170,000 | $86,000 |

Audit and Risk Committee | $15,000 | $7,500 |

People, Culture, Remuneration and Nomination Committee | $15,000 | $7,500 |

No NED equity vested in 2023.

9.2.2 2024 Board and Committee fees

Alongside the review of the aggregate fee limit detailed in section 9.2, the Board also reviewed NED remuneration (Board and Committee fees) during 2023 utilising market analysis prepared by Mercer, as mentioned in section 8.2.

The Mercer review found that Telix's 2023 Board and Committee fees (and aggregate fee pool) are well below remuneration market benchmarks based on market capitalisation and industry. The findings of Mercer's benchmarking review confirmed that Telix’s NED remuneration is placed below or at the 25th percentile (P25) and significantly below the market median (P50) of the market benchmark. In order to attract and retain suitably qualified NEDs and deliver on Telix's strategy, the Board plans to adopt the approach (not a recommendation) provided by Mercer to achieve NED remuneration aligned to P50 over time, aligned to the approach for Executive KMP.

To address the increase in NED remuneration, shareholder approval is first required to increase the aggregate fee pool. If the aggregate fee limit resolution is passed at the 2024 AGM, the Board will increase Director and Committee fees effective 1 January 2024 as follows:

Board and Committee Fees1 | Chair | Member |

|---|---|---|

Board | $230,000 | $115,000 |

Audit and Risk Committee | $30,000 | $10,000 |

People, Culture, Remuneration and Nomination Committee | $20,000 | $10,000 |

Where the proposed NED fees are increased, the travel allowance detailed in section 9.1 will no longer apply.

9.3 2023 Statutory remuneration - NEDs

The table below sets out NED remuneration for 2023 and 2022, prepared in accordance with relevant IFRS and Australian Accounting Standards.

Directors' Fees | Superannuation1 | Share-based payment2 | Total | Options | |||

|---|---|---|---|---|---|---|---|

Name | Year | $ | $ | $ | $ | $ | % |

NEDs | |||||||

H K McCann3 | 2023 | 170,000 | 18,275 | - | 188,275 | - | - |

2022 | 169,998 | 17,425 | - | 187,423 | - | - | |

A Kluge4 | 2023 | 43,000 | - | - | 43,000 | - | - |

2022 | 86,000 | - | - | 86,000 | - | - | |

M Nelson | 2023 | 93,273 | 10,027 | - | 103,300 | - | - |

2022 | 93,273 | 9,560 | - | 102,833 | - | - | |

T Olson5 | 2023 | 104,300 | - | 34,111 | 138,411 | 34,111 | 24.64 |

2022 | 70,725 | - | 22,679 | 93,404 | 22,679 | 24.28 | |

J Skinner | 2023 | 100,727 | 10,828 | - | 111,555 | - | - |

2022 | 100,727 | 10,325 | 2,536 | 113,588 | 2,536 | 2.23 | |

Former NEDs | |||||||

O Buck6 | 2023 | - | - | - | - | - | - |

2022 | 42,750 | - | - | 42,750 | - | - | |

Total | 2023 | 511,300 | 39,130 | 34,111 | 584,541 | 34,111 | n/a |

2022 | 563,473 | 37,310 | 25,215 | 625,998 | 25,215 | n/a | |

2. Following Shareholder approval, premium-priced unlisted share options were issued to Ms Skinner in 2019 and Ms Olson in 2022. The amounts recorded for share-based payments (options) for NEDs reflect the fair value of these options expensed each year over the life of the option. 3. During 2022 and 2023 Mr McCann waived his entitlement to fees as Chair of the PCNRC. 4. As advised to the market on 29 March 2023, Mr Kluge’s remuneration for 2023 excludes his leave of absence the period 29 March 2023 to 29 September 2023 that was unpaid. 5. Ms Olson’s 2022 fees represent period from 31 March to 31 December 2022 due to her commencement date part way through the year. 6. Mr Buck ceased as KMP in May 2022, and was not a KMP in 2023. | |||||||

10 2023 Statutory remuneration – Executive KMP

The below table shows details of the remuneration expenses recognised for Executive KMP for 2023 and 2022 prepared in accordance with IFRS and Australian Accounting Standards.

Fixed remuneration | Variable remuneration | Termination benefit | Total | Variable remuneration | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Salary | Superannuation/Pension | Leave accruals1 | STVR | Share-based payment | ||||||

Name | Year | $ | $ | $ | $ | $ | $ | $ | $ | % |

Executive KMP | ||||||||||

C Behrenbruch | 2023 | 499,282 | 36,632 | 13,081 | 120,244 | 349,222 | - | 1,018,461 | 469,466 | 46.10 |

2022 | 422,345 | 27,500 | 62,405 | 86,976 | 265,311 | - | 864,537 | 352,287 | 40.75 | |

D Smith2 | 2023 | 437,650 | 33,745 | 10,194 | 89,586 | 142,727 | - | 713,902 | 232,313 | 32.54 |

2022 | 172,708 | 11,458 | 21,361 | 24,616 | 8,923 | - | 239,066 | 33,539 | 14.03 | |

R Valeix3 | 2023 | 496,571 | 37,793 | (1,694) | 105,821 | 264,413 | - | 902,904 | 370,234 | 41.00 |

2022 | 39,295 | 2,432 | 9,068 | 4,987 | 3,685 | - | 59,467 | 8,672 | 14.58 | |

C Hayward4 | 2023 | 680,739 | 11,717 | (25,145) | - | 377,177 | 155,252 | 1,199,740 | 377,177 | 31.44 |

2022 | 224,560 | 6,138 | 39,526 | 37,088 | 269,415 | - | 576,727 | 306,503 | 53.15 | |

Former Executive KMP5 | ||||||||||

D Cubbin | 2023 | - | - | - | - | - | - | - | - | - |

2022 | 219,961 | 16,042 | - | - | (17,152) | - | 218,851 | (17,152) | (7.84) | |

G Liberatore | 2023 | - | - | - | - | - | - | - | - | - |

2022 | 218,585 | 16,042 | - | - | (12,941) | 38,714 | 260,400 | (12,941) | (4.97) | |

Total | 2023 | 2,114,242 | 119,887 | (3,564) | 315,651 | 1,133,539 | 155,252 | 3,835,007 | 1,449,190 | n/a |

2022 | 1,297,454 | 79,612 | 132,360 | 153,667 | 517,241 | 38,714 | 2,219,048 | 670,908 | n/a | |

2. D Smith joined the Group on 31 January 2022 as Deputy Chief Financial Officer and was appointed as Chief Financial Officer on 1 August 2022. 3. R Valeix was appointed as Chief Commercial Officer on 5 December 2022. 4. As noted in section 8.1, Dr Hayward resigned as Chief Medical Officer and ceased as Executive KMP effective 31 December 2023. His remuneration is reported to include all amounts associated with his role as KMP for 2023. This includes total fixed remuneration for 2023 (salary and pension) and pay in lieu of notice for the non-compete and non-solicit for three months upon departure. The 2022 and 2023 LTVR PSARs granted in April 2022 and May 2023 respectively are fully expensed and accounted for in 2023 as $377,177 and will remain on-foot, subject to testing at the usual vesting dates. 5. Mr Cubbin and Mr Liberatore ceased as KMP in July 2022, and are not KMP in 2023. | ||||||||||

11 Additional statutory disclosures

11.1 Ordinary shareholdings

The relevant interests of KMP in the shares issued by Telix, held directly, indirectly or beneficially either personally or by their related parties are included in this section.

11.1.1 NED ordinary shareholdings

Name | Balance 1 January 2023 | Shares issued from Options exercised | Net acquired/(disposed) | Other changes | Balance 31 December 2023 |

|---|---|---|---|---|---|

H K McCann | 1,150,000 | - | - | - | 1,150,000 |

A Kluge | 22,675,000 | - | - | - | 22,675,000 |

M Nelson | 3,628,750 | - | - | - | 3,628,750 |

T Olson | 43,930 | - | 51,3051 | - | 95,235 |

J Skinner | 595,000 | - | - | - | 595,000 |

28,092,680 | - | 51,305 | - | 28,143,985 | |

11.1.2 Executive KMP ordinary shareholdings

Balance 1 January 2023 | Shares issued from Options exercised | Net acquired/(disposed) | Other changes | Balance 31 December 2023 | % of base salary held in shares1 | |

|---|---|---|---|---|---|---|

C Behrenbruch | 23,075,000 | - | - | - | 23,075,000 | 48901% |

D Smith | 6,500 | - | - | - | 6,500 | 16% |

R Valeix | 125,000 | - | - | - | 125,000 | 245% |

C Hayward2 | - | 244,621 | - | - | 244,621 | 367% |

23,206,500 | 244,621 | - | - | 23,451,121 | ||

2. Dr Hayward resigned as Chief Medical Officer and ceased as Executive KMP effective 31 December 2023. | ||||||

11.2 KMP option holdings for the year ended 31 December 2023

11.2.1 NED option holdings

Name | Grant date of options | Number of options granted | Exercise price $ | Expiry date | Fair value per option at grant date $ | Vesting date | Vesting number | Vested during the year | Lapsed or forfeited during the year | Exercised in current or prior year | Eligible to exercise at 31 December 2023 | Unvested at 31 December 2023 | Maximum value yet to vest $ |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

H K McCann | - | - | - | - | - | - | - | - | - | - | - | - | - |

A Kluge | - | - | - | - | - | - | - | - | - | - | - | - | - |

M Nelson | - | - | - | - | - | - | - | - | - | - | - | - | - |

T Olson | 18-05-22 | 52,070 | 4.95 | 18-05-27 | 2.1865 | 31-12-24 | 52,070 | - | - | - | - | 52,070 | 57,060 |

J Skinner | 22-05-19 | 495,000 | 1.09 | 24-01-23 | 0.23 | 24-01-22 | 495,000 | - | - | 495,000 | - | - | - |

Total | 547,070 | 547,070 | - | - | 495,000 | - | 52,070 | 57,060 |

11.2.2 Executive KMP option holdings

Name | Grant date of options | Number of options granted | Exercise price $ | Expiry date | Fair value per option at grant date $ | Vesting date | Vesting number | Vested during the year | Lapsed or forfeited during the year | Exercised in current or prior year | Eligible to exercise at 31 December 2023 | Unvested at 31 December 2023 | Maximum value yet to vest $ |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

C Behrenbruch | 23-05-19 | 400,000 | 1.09 | 24-01-23 | 0.23 | 24-01-22 | 400,000 | - | - | 400,000 | - | - | - |

13-01-20 | 200,000 | 2.23 | 12-01-24 | 0.46 | 12-01-23 | 200,000 | 200,000 | - | - | 200,000 | - | - | |

26-01-21 | 100,708 | 4.38 | 26-01-26 | 2.12 | 28-10-22 | 100,708 | - | - | - | 100,708 | - | - | |

5-04-22 | 139,672 | 4.95 | 4-04-27 | 2.43 | 31-12-24 | 139,672 | - | - | - | - | 139,672 | 170,278 | |

24-05-23 | 120,268 | 6.90 | 24-05-28 | 7.65 | 31-12-25 | 120,268 | - | - | - | - | 120,268 | 680,473 | |

D Smith | 24-10-22 | 45,449 | 6.15 | 24-10-27 | 3.08 | 31-12-24 | 45,449 | - | - | - | - | 45,449 | 71,154 |

24-10-22 | 32,463 | 6.15 | 24-10-27 | 3.08 | 31-12-24 | 32,463 | - | - | - | - | 32,463 | 50,823 | |

2-05-23 | 70,798 | 6.90 | 27-03-28 | 3.79 | 31-12-25 | 70,798 | - | - | - | - | 70,798 | 198,276 | |

R Valeix | 21-07-21 | 75,000 | 5.37 | 20-07-26 | 2.62 | 28-10-22 | 75,000 | - | - | - | 75,000 | - | - |

21-07-21 | 125,000 | - | 20-07-26 | 5.35 | 28-10-22 | 125,000 | - | - | 125,000 | - | - | - | |

5-04-22 | 89,300 | 4.95 | 4-04-27 | 2.43 | 31-12-24 | 89,300 | - | - | - | - | 89,300 | 108,868 | |

2-05-23 | 81,214 | 6.90 | 27-03-28 | 3.79 | 31-12-25 | 81,214 | - | - | - | - | 81,214 | 227,447 | |

6-07-23 | 35,000 | - | 15-06-28 | 10.79 | 31-12-25 | 35,000 | - | - | - | - | 35,000 | 258,369 | |

C Hayward | 1-07-20 | 400,000 | 1.83 | 1-07-24 | 0.42 | 1-07-23 | 400,000 | 400,000 | - | 400,000 | - | - | - |

26-01-21 | 140,661 | 4.38 | 26-01-26 | 2.12 | 28-10-22 | 140,661 | 140,661 | - | 140,661 | - | - | - | |

5-04-22 | 85,185 | 4.95 | 4-04-27 | 2.43 | 31-12-24 | 85,185 | - | - | - | - | 85,185 | 51,959 | |

2-05-23 | 79,336 | 6.90 | 27-03-28 | 3.79 | 31-12-25 | 79,336 | - | - | - | - | 79,336 | 65,090 | |

2,220,054 | 2,220,054 | 740,661 | - | 1,065,661 | 375,708 | 778,685 | 1,882,737 |

11.3 Related party transactions with KMP

Remuneration: Remuneration to KMP is recorded in the tables above.

Loans: There were no loans between the Group and any KMP in the years ended 31 December 2023 and 2022.

Other transactions: Refer to note 33.2 of the Financial report for further details.

Other than those noted above, there were no related party transactions with any KMP in the year ended 31 December 2023.

This Directors’ report is approved in accordance with a resolution of the Directors.

|  | ||

H Kevin McCann AO | Christian Behrenbruch | ||

22 February 2024 | 22 February 2024 | ||

- Adjusted Earnings Before Interest, Tax, Depreciation, Amortisation and Research and Development Expense